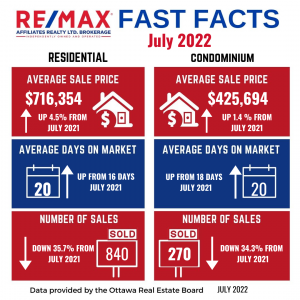

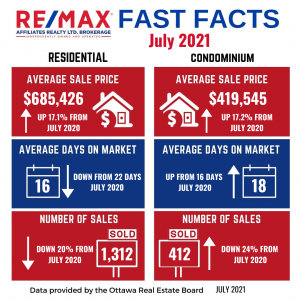

July Real Estate Stats for Ottawa

Price improvements happening in Ottawa! If you’re thinking about buying – make sure you get your rate LOCKED IN TODAY and lets get active! If you’re thinking of selling – I’ll get your home sold with my VERIFIED LISTING PROGRAM! Pricing is currently sitting at 2021 levels – down from this years peak…