Ottawa Real Estate Settling Back into a normal August

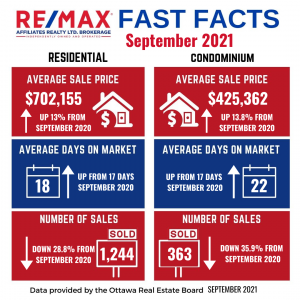

OTTAWA, September 3, 2021 – Members of the Ottawa Real Estate Board sold 1,572 residential properties in August through the Board’s Multiple Listing Service® System, compared with 2,006 in August 2020, a decrease of 22 per cent. August’s sales included 1,175 in the residential-property class, down 25 per cent from a year ago, and 397 in the condominium-property category, a decrease…

DetailsTop Home Cleaning Hacks!

When you go to the store there’s no shortage of cleaning products lining the shelves. From scent-free toilet cleaner to specific sprays to clean stainless steel appliances, it can sometimes feel like we’re spending more money on cleaning our homes than decorating them! If only there was a way to clean our homes using household…

DetailsJune’s Residential Resale Market begins to Normalize in Red Hot Ottawa

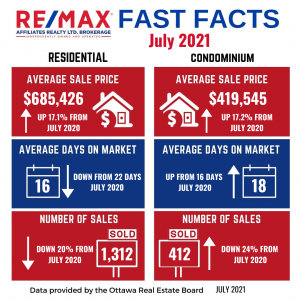

OTTAWA, July 6, 2021 – Members of the Ottawa Real Estate Board sold 2,131 residential properties in June through the Board’s Multiple Listing Service® System, compared with 2,038 in June 2020, an increase of 5 per cent. June’s sales included 1,647 in the residential-property class, up 2 per cent from a year ago, and 484…

DetailsPent-up Buyer Demand Drives January’s Resale Market

Members of the Ottawa Real Estate Board sold 964 residential properties in January through the Board’s Multiple Listing Service® System, compared with 778 in January 2020, an increase of 24 per cent. January’s sales included 674 in the residential-property class, up 21 percent from a year ago, and 290 in the condominium-property category, an increase…

DetailsCanadian Homes Over $1M Mark Expected to Grow in Value By 7.5% in 2021

Following a historically slow spring season — a time that is known for being bustling for real estate — Canadian homebuyers returned to markets across the country to take advantage of low-interest rates during the post-lockdown period, even within the luxury home sector. Subsequently, a number of major Canadian real estate markets saw unprecedented demand…

DetailsOttawa Up Apx 20% through 2020 – 2021 Expected to be STRONG

OTTAWA, January 6, 2021 – Members of the Ottawa Real Estate Board (OREB) sold 1,002 residential properties in December through the Board’s Multiple Listing Service® System, compared with 757 in December 2019, an increase of 32.4 per cent. December’s sales included 710 in the residential property class, up 33.7 per cent from a year ago, and…

DetailsOttawa’s Resale Market “Steady as She Goes” with an Increase in Listings – Finally!

Members of the Ottawa Real Estate Board sold 2,146 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,604 in October 2019, a year over year increase of 34 per cent. October’s sales included 1,665 in the residential-property class, up 38 per cent from a year ago, and 481 in the…

DetailsCMHC Tightening Real Estate Lending Guidelines – Others NOT following suit!

*Canadians of all stripes were blindsided on June 4, when the Canadian Mortgage and Housing Corporation suddenly revised certain key underwriting guidelines. The story got a little more interesting on Monday, when CMHC’s competitors in the mortgage insurance space, Genworth Canada and Canada Guaranty, both announced they would not be following suit. “Genworth Canada believes that its risk management…

DetailsUP 19%: Shrinking Ottawa housing supply drives up resale prices in January

The big story of Ottawa’s real estate market for the past few years has been shrinking supply. Few people are putting their homes or condos up for sale until they have someplace to go. In January, the scarcity of listings plumbed a whole new depth. The result: the average price for residential resales soared 19.3…

DetailsNo change to Bank of Canada key rate

The Bank of Canada announced today that it is keeping its benchmark rate unchanged despite a weaker economy in the fourth quarter of last year and expectations that growth in the near term will be weaker. Should the recent slowdown in growth be more persistent than forecast, we may see a rate cut. In…

DetailsCanada’s high-end housing prices to see healthy growth this year

A global luxury property firm has predicted that homes in Canada worth $1 million and above will see their prices grow by around 4% in 2020, largely due to sustained demand and last year’s housing market robustness. In its newly released “Canadian Year-End Luxury Real Estate Report,” Engel & Völkers noted that the combination of…

DetailsSupply shortage drives Ottawa house prices up nine per cent in 2019!!

The average sale price last year for residential properties across the city was $486,600. Ottawa’s housing market appears trapped in a troublesome cycle. Fewer than 1,800 residential homes and condominiums were listed for sale at the end of December, according to data published Monday by the Ottawa Real Estate Board. While this suggests reasonable…

DetailsNew Federal Home Buyers Program Breakdown

Launching earlier this week, the federal government’s new home buyers program aims to help nearly 100,000 Canadians achieve their home ownership dreams while helping with the monthly payments. The programs offer a 5% down payment amount for default insured mortgages, 10% for new construction, as a no interest second mortgage. There are some prominent conditions…

Details