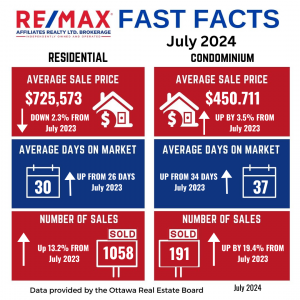

July 2024 Ottawa Real Estate Stats

Numbers are pretty much holding steady pricewise from last month but are still down from last year… Sales are up a bit in terms of freehold homes but condos are still down significantly from 2023. Lots of opportunities out there with more interest rate drops expected!

Interest Rate Announcement Post

OPEN HOUSE JULY 28TH

Join me this Sunday, July 28th, from 2-4 PM for an exclusive Open House at 1518 Beaverpond Dr, Unit E! Explore your future home sweet home! 🎉 #OpenHouse #RealEstate #HomeSweetHome

RankMyAgent Review

Always a pleasure to work with my clients!

#greatclients #ottawarealestate #tomsapinskilovesottawa #clientappreciation

Just purchased in no time!

#ottawarealestate #ottawarealtor #ottawahomes #realestate #ottawabusiness #ottawarealestateagent #remax #Canada #ottawarealtors #ottawahomesforsale #realestateagent #realestateottawa

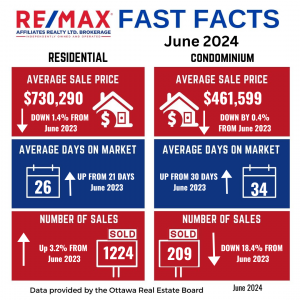

June 2024 – Fast Facts!

Rank My Agent Review

What a wonderful review! This is so inspiring and truly what keeps me going! #greatclients #ottawarealestate #tomsapinskilovesottawa #clientappreciation

Home Sweet Home!

Wow! This home has so many great features! Years of memories will be made in this gorgeous backyard. Another huge thanks to E and K for their patience and perseverance. Buying and selling homes is not an easy thing to do – neither is keeping such a cool head through it all! Congrats again! #ottawarealestate #ottawa #ottawarealtor #ottawahomes #realestate #ottawalife #ottawaliving…

DetailsJust Sold in Chapel Hill!

So nice when things work out for great people! Big congrats to Erick and Kathleen on selling their first home and moving onto their next adventure!

Another home gone!

#ottawarealestate #ottawa #ottawarealtor #ottawahomes

#realestate #myottawa #ottawalife #ottcity #ottawaliving

#realtor #yow #ottawabusiness #ottawacity #kanata

#ottawarealestateagent #remax #ontario #ottawatourism

#orleans #ottawarealtors #canada #stittsville #ottawaeast

New Purchase!

#ottawarealestate #ottawa #ottawarealtor #ottawahomes

#realestate #myottawa #ottawalife #ottcity #ottawaliving

#realtor #yow #ottawabusiness #ottawacity #kanata

#ottawarealestateagent #remax #ontario #ottawatourism

#orleans #ottawarealtors #canada #stittsville #ottawaeast

Another house gone off the market!

Rates on the move🏃♂️

#ottawarealestate #ottawa #ottawarealtor

#ottawahomes #realestate #myottawa #ottawalife

#ottcity #ottawaliving #realtor #yow #ottawabusiness

#ottawacity #kanata #ottawarealestateagent #remax

#ontario #ottawatourism #orleans #ottawarealtors

#canada #stittsville #ottawaeast #ottawahomesforsale

Sold!!

So nice working with some of my longest tenured clients! Huge thanks to Bryan and Susan for sticking with me all these years!

New Numbers!!

Residential numbers are down from last month but condo pricing has increased significantly… Same scenario on a yearly basis… Some investors might have been trying to stay ahead of interest rate decreases – which could lead to higher prices. Condos are a very common investment vehicle… #ottawarealestate #ottawarealtor #ottawahomesforsale #tomsapinskilovesottawa #ottawarealestate #ottawa #ottawarealtor #ottawahomes #realestate #myottawa #ottawalife #ottcity #ottawaliving #realtor #yow #ottawabusiness #ottawacity #kanata…

DetailsJust rented!🎉

#ottawarealestate #ottawa #ottawarealtor

#ottawahomes #realestate #myottawa

#ottawalife #ottcity #ottawaliving #realtor

#yow #ottawabusiness #ottawacity #kanata

#ottawarealestateagent #remax #ontario

#ottawatourism #orleans #ottawarealtors

#canada #stittsville #ottawaeast #ottawahomesforsale

Freshly unveiled on the market!

#ottawarealestate #ottawa #ottawarealtor #ottawahomes

#realestate #myottawa #ottawalife #ottcity #ottawaliving

#realtor #yow #ottawabusiness #ottawacity #kanata

#ottawarealestateagent #remax #ontario #ottawatourism

#orleans #ottawarealtors #canada #stittsville #ottawaeast

Another beautiful condo purchased!

#ottawarealestate #ottawa #ottawarealtor #ottawahomes

#realestate #myottawa #ottawalife #ottcity #ottawaliving

#realtor #yow #ottawabusiness #ottawacity #kanata

#ottawarealestateagent #remax #ontario #ottawatourism

#orleans #ottawarealtors #canada #stittsville #ottawaeast

New sales!

Thanks so much Peggy and her wonderful family. So happy the sale worked out well and we were able to get a quick closing date!

#greatclients #ottawaphotography