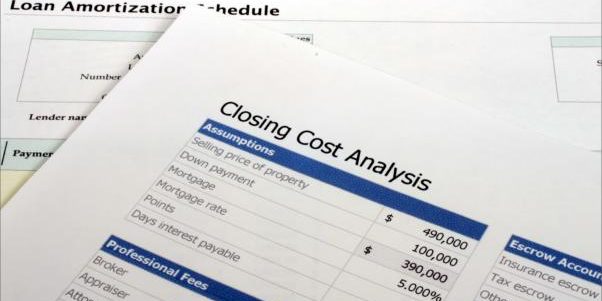

Don’t forget closing costs when buying a home

Despite the low cost of carrying a mortgage these days, you should keep in mind “closing costs” in addition to your down payment for that dream home.

These various charges can add up, and for the most part they are all legally required payments in buying a property. Here is a list of most of your major “closing costs.”

- Legal fees: Since a lawyer is an essential part of your home-buying team, the work provided involves fees. Most legal fees include searching the title of the property, arranging a property survey if necessary and handling other disbursements as required.

- Mortgage insurance and application fee: For any high ratio mortgage, which is any mortgage in which 75 or more per cent of the house’s purchase price is covered by the mortgage, the lender requires mortgage insurance.

- Mortgage broker’s fee: A mortgage broker may charge a fee to set up a mortgage for you. In some cases the fee may be included with the legal fees if your lawyer arranges the mortgage, or included in the lender’s fees if you deal directly with a lender such as a bank.

- Property insurance: This insurance covers the replacement value of your home and its contents. Most mortgage lenders will require proof that you have this insurance before processing a mortgage.

- Home Inspection: A professional home inspector knows what to look for and can confirm or add to the information you’ve gleaned from the REALTOR® or your inspection. Basic inspections on most houses are usually in the $400 to $500 range.

- Land transfer tax: Anyone buying property inOntario must pay a land transfer tax. It usually runs between 0.5 to two per cent of the home’s purchase price, depending on that price.

- GST: GST is payable to some degree on the purchase price on all new homes, although partial rebates are available on the purchase of most homes. A resale residential home is usually exempt from GST. Various other closing fees, however, do involve payment of GST.

- Extra charges: You may also be required to pay the costs of such things as heating oil in the tank, or other costs incurred by the seller, but included with the house, prior to the closing day.

- Hook-ups: There may be hook-up charges required for appliances and services such as telephone, TV cable, hydro and other utilities.

- Moving costs: Don’t forget the basic costs involved in moving from your old place into your new home, particularly if you use a professional moving company.

A REALTOR® can explain further details on closing costs. Just remember to add them to your financial plan when saving to buy a home.

Source: Ontario Real Estate Association